Capital raising can be very exciting.

Although, with increasing compliance requirements and calls for transparency across NZ’s financial markets, it can create uncertainty on how to proceed. Particularly for businesses raising capital for the very first time.

Let's look at 5 typical steps to a capital raise!

Step 1: What is your business' purpose for new capital funding?

Decide why your business needs capital.

For instance:

- Assets: Is it to buy land or specialist equipment?

- People: Do you want to hire talent to develop & market a new product?

- Strategic Partnerships & Credibility: Do you want experienced investors who can add-value to your board’s expertise & give your business credibility?

Or perhaps, it is a mixture of all the above?

Step 2: The importance of choosing the right corporate structure to raise capital for your business.

Company or Partnership: In other words, what entity will investors pay funds into? Although, it may pose obvious to have the investor pay into the company you currently trade in. You may find upon further discussion with your IP, tax and legal advisors, that its better to raise through a new special purpose company, limited partnership or other managed investment scheme.

Dream Team: Choosing your legal structure is an important step. Ideally, you should rally your various advisors to the table to discuss and ensure that any holes in your offer aren't missed.

Step 3: Once you have decided on your capital raising purpose & structure, you can start documenting per legal and disclosure requirements.

There are 3 core documents to most typical capital raises:

- Investment Agreement (short ~4-6 pages).

- Information Memorandum (medium / enough for a 30-minute sitting ~30 pages).

- Governance Agreement - Shareholders Agreement, Limited Partnership Agreement or Trust Deed (long ~30-60 pages).

(1) Investment Agreement

Let’s start with the investment agreement. This document will record whether you are going to be raising capital via debt or equity.

Debt

- Bank: If you’re raising via debt, your first instinct may be to ask the bank. However, particularly if you’re an early stage company or operating at a loss, the bank is unlikely willing to give you a loan due to the need for cash flow (revenue) to service their loans.

- Investors: In which case the other debt capital raising option is to get loans from investors (i.e. high-net worths, family & close business associates).

- Interest & Frequency of Payment: The investment agreement typically records how much interest you will be prepared to pay to the investor (i.e. a fixed % on the principal loan amount) and how frequently you will pay them the interest (i.e. monthly, quarterly or other time frame).

Equity

- Shares or Units: On the other hand, if you want to raise by equity (which means that you are willing to give the investor some ownership in your business) you will typically trade investor capital in exchange for shares or units in your business.

- Voting Rights: Ownership via equity typically means that you are giving the investor access to both income and voting rights. At times, you may see equity offers only offering rights to income. You will need to determine whether it is appropriate for the type of investor, you are looking to attract, to have a say in how your businesses is run.

Hybrids: But there are several ways to “cut this cake”, where you can have offers with a mixture of both debt and equity. You may have heard of convertible loan agreements where essentially you start off with the loan arrangement and at a specific and strategically determined date, that investor's interest in your business turns into equity.

Other: Without going into great detail, other items to include in your investment agreement include covering when the investor pays the funds, what information you need about the investor before you can accept their investment (i.e. AML, tax codes etc) and any warranties required from the company (i.e. accuracy of company records) or the investor (i.e. any ID & certificates they provide are true and correct).

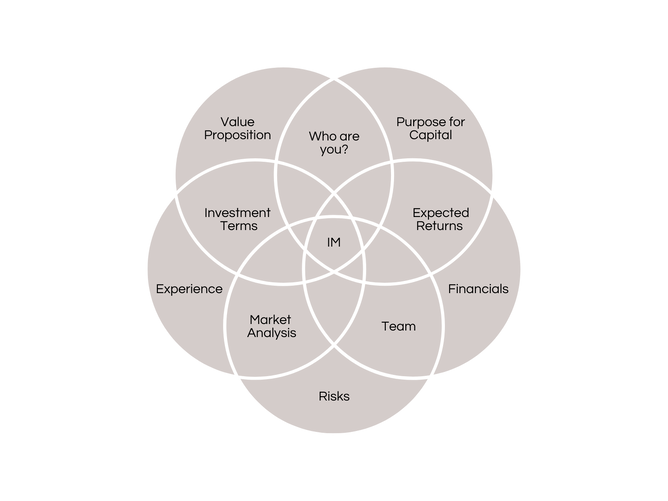

(2) Information Memorandum

The next document is optional for most private investments but we’re seeing more and more people preparing these, as an industry standard, and that is an information memorandum (IM).

The IM is a wonderful, well-recognised, marketing document that essentially lays out:

- Who is on your team?

- What does your business need the capital for?

- Why do you need investors?

- When do you need the funds?

- How do you plan on achieving target returns?

Executive / Offer Summary: Other details in the IM include having a 1-2 page executive summary (or a table) that clearly lays out the terms of your offer such as:

- Start and close dates of when the offer will be available.

- How much is the return?

- When will it be paid?

- Will financial reporting be available?

Financials: This important section of the IM focuses on the numbers. We’re talking clear and relevant numbers, graphs and tables.

Investors will want to know that you have done the maths to see how use of their investment will affect business margins. This includes an explanation of any assumptions you have made to come to any financial conclusions, such as how you have calculated your expected average returns to investors.

(3) Governance Agreement

SHAG or LPA: Another key document is the governance agreement, which can take the form of a shareholders agreement (SHAG) or limited partnership agreement (LPA).

Typical Headings of Governance Agreements: Common headings for these two governance documents include:

- Distribution Policy: How dividends or distributions will be managed?

- Investor Transfer/Exit: What process an investor must follow to exit or sell their interests?

- Rights: What rights are attached to equity or loan units in the business?

- Dispute Resolution: Who may need to be involved and how quickly disputes are to be managed?

Step 4: Every capital raising business needs to consider compliance under the Financial Markets Conduct Act 2013.

Ensure that your offer and documents meet FMCA compliance.

The Act: The Financial Markets Conduct Act 2013 is a beautiful piece of legislation, all 487 pages of it. This document governs how trading is to occur across NZ capital markets, particularly protecting those who are retail investors (i.e mums and dads) versus wholesale investors (i.e. who trade securities regularly).

Wholesale Investors: If offers are only available to wholesale investors, this means that there are less protections for wholesale investors because there is an assumption that they know what they’re doing in terms of trading financial products. Where, disclosure to wholesale investor is not required to such a high level.

Act disclosure exemptions also apply for investment received from your family and close business associates.

Certificates Required: If you are going to receive investment from wholesale investors you still need certifications from them. These are 1-2 page documents, largely prescribed by the Act, that the investor signs off on. Also, note that there are about 10 different types of persons who are all considered wholesale and you will want to clearly record who is who.

Eligible Investors: For persons who are on the brink of wholesale, or eligible investors, who have from time to time invested in financial products are allowed to participate in wholesale offers so long as their grounds of investment experience can be signed off / confirmed by their accountant, lawyer or financial advisor.

Step 5: Efforts to capital raise are nothing without a strong sales team skilled in investor relations.

Interaction & Engagement: Time to sell. And as easy as this might sound, you do not want to underestimate this part of the capital raising process. Some people might think, I’ve done steps 1 to 4, I’ve got my documents in place, I’ll just hand them over to investors and wait.

Investor Relations: However, experience shows that there’s a bit more to investor relations where you are going to need to talk through your offer documents with investors. Which is fair enough, as investors should want to know and talk to who they are placing their money with.

Expect Questions from Investors: So not only be prepared to field questions from investors, but also be prepared to potentially address questions from their lawyer (who will likely be asked to review the offer documents and advise their client accordingly).

Invest in Sales: If there is little budget to spend in sales, be prepared to invest your time engaging with investors. So whether it’s the business founders or a dedicated investor relations team (or both) who are positioned to sell the offer, ensure that the team understands the offer documents and can clearly communicate it to potential investors.

Concluding Comments on Key Steps to Capital Raising

As you can tell, these five steps are high level. Hopefully, they give you a helpful indication on the typical structure of a capital raise.

It will pay to flesh out each of these five steps with your advisors "round-table" or "zoom-gallery" style.

Please reach out to Janey at janey@jhlaw.nz if you have any questions regarding the above. The above is purely for informational purposes, where JH LAW will need to determine if the above information is applicable or appropriate to your particular situation.